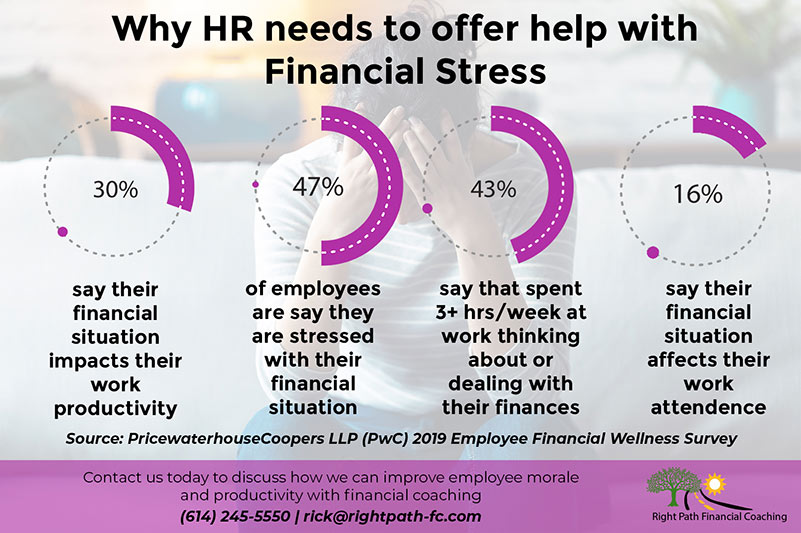

Much has been reported on the financial stress on households around the country. Less known, but just as impactful is how that stress is brought into the workplace. As a result, many employers are experiencing higher turnover, lower productivity, and lower profits.

According to results of a 2019 survey by www.salaryfinance.com , employees with money worries are:

2.2 times more likely to seek employment elsewhere

5.8 times more likely not to be able to finish daily tasks

4.9 times more likely to have lower work quality

and 8 times more likely to have sleepless nights

Further findings show that 11% to 14% of payroll cost is directly related to poor financial wellness.

Offering and promoting financial wellness education in the workplace is key to turning this ship around. AND it doesn’t have to be expensive, so it can be a great return on investment both quantitatively & qualitatively. That’s where a financial coach can offer value. Passion for helping people is what attracts people to this profession. When people gain financial knowledge the trajectory of their lives is changed.

Offering and promoting financial wellness education in the workplace is key to turning this ship around. AND it doesn’t have to be expensive, so it can be a great return on investment both quantitatively & qualitatively. That’s where a financial coach can offer value. Passion for helping people is what attracts people to this profession. When people gain financial knowledge the trajectory of their lives is changed.

A financial coach brings an unbiased and comprehensive approach to personal finance. In group settings, topics such as budgeting, credit, insurance, and debt are discussed. Private sessions not only look hard at the numbers but also encompass discussions with clients about their values and behaviors that influence financial decision-making.

When it comes to improving the level of financial literacy in this country, employers that take an active role stand to reap the dual reward of an improved bottom line and less stressful work environment.

Rick is an Accredited Financial Counselor with a passion for teaching people how to manage their money so they are making better decisions and have less stress in their lives. He can be reached at rick@rightpath-fc.com.

Recent Comments